News about a possible investigation into Tether caused panic in the cryptocurrency world, leading to a drop in prices. Bitcoin (BTC) and Ethereum (ETH) were hit hard, with many other cryptocurrencies also losing value. USDT, a stablecoin that normally stays very close to $1, briefly fell to $0.99, which is a small drop and within its usual range.

Wall Street Journal Reports on Tether Investigation

The Wall Street Journal published an article claiming that U.S. authorities are investigating Tether for breaking certain laws. According to the report, the U.S. Attorney’s Office in Manhattan wants to find out if Tether was used in illegal activities, such as:

- Terrorism financing

- Drug trafficking

- Hacking

The article also mentions that the U.S. Treasury Department is considering placing sanctions on Tether. Sanctions would limit how Americans can use Tether, especially if it is connected to groups that the U.S. government has blacklisted, such as Hamas and Russian arms dealers. If the government decides to apply sanctions, people in the U.S. might be restricted from buying or holding Tether.

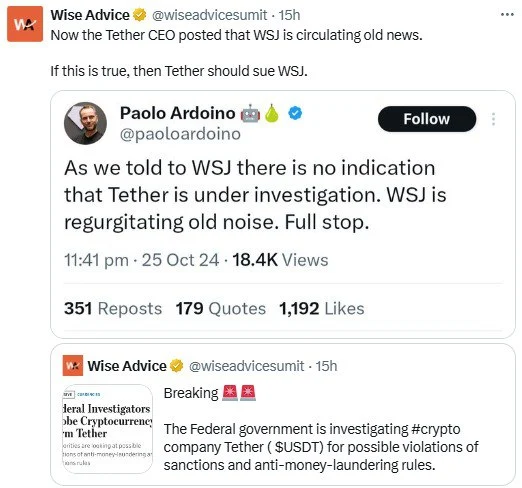

Tether CEO Responds to the Allegations

Tether is a well-known stablecoin, always aimed to match the value of the U.S. dollar. Every day, Tether sees about $190 billion in transactions, helping people and businesses in places where U.S. dollars are not easy to use. However, authorities are worried that Tether might be involved in activities linked to dangerous organizations, including:

- North Korea’s nuclear program

- Mexican drug cartels

Tether’s CEO, Paolo Ardoino, responded to the Wall Street Journal’s claims. He said that these accusations are just another wave of FUD (Fear, Uncertainty, and Doubt). Ardoino reminded everyone that Tether had already gone through a major investigation by the New York Attorney General in the past but continued operating as usual. He also said that Tether works closely with investigators to fight fraud and theft in the crypto world.

How Tether Handles Security and Compliance

Tether says it has strict rules for verifying user accounts, though the use of USDT is still anonymous and does not require permission from any authority. Since Tether operates on different blockchain networks, it is harder to monitor how it is used. But the company insists that it has cooperated with authorities over the years to identify bad actors.

Several years ago, the U.S. Justice Department investigated Tether for possible bank fraud. Since then, the company has improved its methods to detect and prevent illegal activities. Tether has taken several steps to strengthen its security, including:

- Partnering with Chainalysis and TRM Labs to monitor transactions

- Hiring a government affairs expert from PayPal to improve its relationship with regulators

How the Market Reacted to the News

The news about Tether being investigated triggered a sharp drop in the crypto market. Bitcoin fell below $67,000, and Ethereum (ETH) also dropped. Popular stablecoins like USDT and USDC dipped slightly to $0.99 but remained stable within their usual range. Other cryptocurrencies, known as altcoins, saw their prices fall between 5% to 10%.

However, the market soon started to recover. Bitcoin initially fell to $66,000 but quickly bounced back to around $66,700 within minutes. Ethereum also dropped to $2,461 but showed signs of rising again.

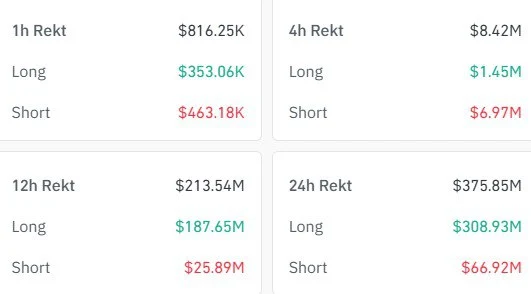

Liquidations and Market Losses

The sudden drop in prices caused many traders to lose money. A total of $375.85 million worth of trades were liquidated (automatically closed) as the market became unstable. Most of these losses came from traders who had placed long trades, betting that prices would go up. About $308.93 million worth of these trades were liquidated. In just 24 hours, 133,857 traders had to close their positions because of the rapid market changes.

What Analysts Say About the Tether News

Some experts believe that the negative news about Tether may have been intended to slow down Bitcoin’s rally. They argue that the sudden panic might have been a tactic to shake the market before prices rise again. Despite the worries, Tether has remained a key part of the cryptocurrency world for over 10 years. It has only experienced a few minor events where its value moved away from the $1 mark.

Some traders view the Tether news as just FUD and think it was used to reduce market liquidity before a new rally. Others believe that the situation may lead to more price drops, but many remain hopeful that the market will recover soon.

Conclusion

In summary, the news of a possible investigation into Tether caused fear and confusion, leading to a crash in the crypto market. Bitcoin, Ethereum, and many other coins saw their prices drop, although they started to recover quickly. Tether’s CEO dismissed the investigation as another attempt to spread fear, reminding everyone that Tether has faced challenges before and continued to grow.

Although there are concerns about Tether’s involvement in illegal activities, the company has made efforts to improve its compliance and security. With the crypto market being highly unpredictable, traders will need to stay cautious as they watch how the situation with Tether develops. Despite the recent panic, many believe that the crypto market is strong enough to bounce back, possibly even stronger than before.