With the US Presidential Election set for November 5, 2024, financial markets, including cryptocurrencies, are reacting quickly. In the past, Bitcoin’s value has often increased after election results, as traders and investors adjust to new political changes. This year, the outcome of the election is expected to impact not just stocks and currencies but also the entire crypto market.

Bitcoin Prices Reached a New High in March 2024

Bitcoin’s value soared to an all-time high of $73,798 in March, boosted by optimism around Exchange-Traded Funds (ETFs). ETFs allow people to invest in Bitcoin more easily, and many investors expect more favorable crypto regulations after the new government takes over.

How the Election Could Impact Crypto Policies

The 2024 US Presidential Election plays a big role in shaping the future of cryptocurrency regulations. Both Donald Trump, the Republican candidate, and Kamala Harris, the Democratic candidate, have shown interest in cryptocurrencies. However, their views are quite different:

- Donald Trump: He has talked about making Bitcoin a strategic reserve and turning the US into a global hub for crypto. His supporters believe his leadership will reduce regulations on crypto.

- Kamala Harris: While Harris wants to provide clear guidelines for the crypto market, she favors organized rules to protect investors and prevent fraud. If she wins, her policies could bring more stability and clarity to the crypto space.

During the current Biden administration, regulations on cryptocurrencies have been stricter. As a result, crypto regulation is now a major topic in the 2024 election campaign.

Crypto Donations Play a Big Role in the 2024 Election

Cryptocurrency is not just influencing financial markets—it’s also shaping the election campaigns. Political donations in crypto have exceeded $190 million, with funds being directed toward both the House of Representatives and Senate races.

- Pro-Crypto Candidates: In the Senate, candidates like Ruben Gallego (Arizona) and Elissa Slotkin (Michigan) have received nearly $10 million each from crypto-friendly donors.

- Ripple’s Chris Larsen: He donated large amounts of cryptocurrency, including $10 million in three installments, to support Kamala Harris.

- Republican Campaigns: On the Republican side, candidates like Bernie Moreno (Ohio) and Michelle Steel (California) are also benefiting from large crypto donations. One-third of Moreno’s campaign funds—more than $40 million—came from crypto supporters.

Even former President Donald Trump’s campaign has raised around $7.5 million in crypto donations.

Trump’s Chances and Predictions for the Election

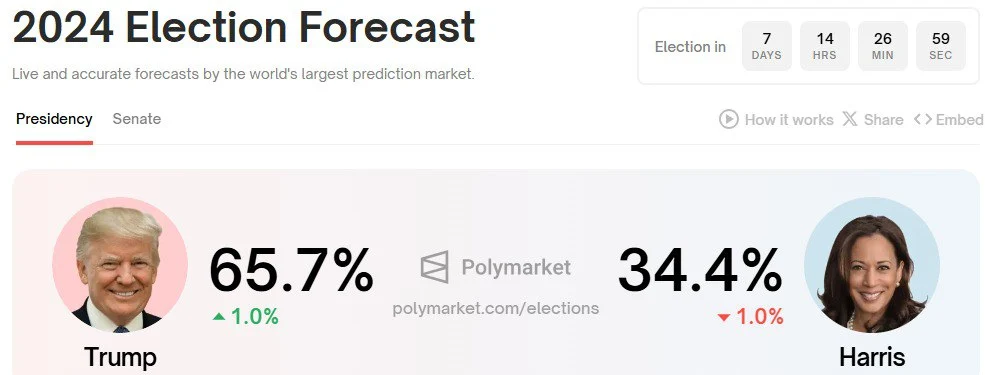

Trump’s vocal support for cryptocurrency has gained attention. His campaign even introduced a digital currency platform called World Liberty Financial, attracting both political and crypto enthusiasts. Prediction markets like Polymarket show Trump leading the race with 65.7% support, while Harris is behind at 34.4%.

However, Trump’s chances aren’t equal across all states. For example, in places like Wisconsin and Michigan, his odds are lower, with support dipping below 60%. Despite this, many high-stakes bettors have placed big bets on his victory, which has further boosted confidence among his supporters.

Bitcoin’s History During Past US Elections

Looking back, Bitcoin has performed well during previous US elections.

- 2016 Election: Before the election, Bitcoin traded at around $700. By the end of 2017, its price skyrocketed to nearly $20,000.

- 2020 Election: Bitcoin’s price was about $15,500 in November 2020. A year later, it reached almost $69,000 in November 2021.

This year, however, Bitcoin’s price already hit a record high of $73,500 in March 2024, months before the election. This is different from past cycles, where Bitcoin typically surged after the election results.

The Role of Bitcoin ETFs in the Market

One of the major reasons for Bitcoin’s recent growth is the approval of US Spot Bitcoin ETFs. These ETFs allow investors to buy Bitcoin more easily through traditional financial systems. As of October 18, 2024, these ETFs have brought in $2.4 billion in just six days, increasing confidence in the market.

Currently, Bitcoin is trading around $67,700, with the entire crypto market valued at $2.39 trillion. Bitcoin’s market dominance—meaning the percentage of the total crypto market it controls—stands at 55.8%.

What to Expect After the 2024 Election

Regardless of who wins the election, 2024 is shaping up to be a big year for crypto. Both Trump and Harris have shown an interest in supporting the crypto industry, though in different ways.

- If Trump wins, his policies may attract more investors by reducing restrictions on Bitcoin and other digital currencies.

- If Harris wins, her structured approach could stabilize prices and make it easier for businesses to operate within clear rules.

In either case, the new government is expected to be crypto-friendly, which will likely encourage more adoption of digital currencies.

Final Thoughts: Will Bitcoin Hit $100,000?

Bitcoin’s journey in 2024 has been impressive. It has already reached a new all-time high, and many experts believe that if the momentum continues, the price could soon hit $100,000. The outcome of the US Presidential Election could provide the final push that Bitcoin needs to break through.

At the same time, the growing involvement of crypto in politics means that more lawmakers will be aware of the potential of digital currencies. With millions of dollars in crypto donations flowing into political campaigns, the relationship between crypto and government is becoming stronger than ever.

While we can’t say for sure how Bitcoin will perform after the election, one thing is clear: cryptocurrencies will play a significant role in shaping the future of the economy and politics in the United States and beyond.