Berachain is a new type of blockchain that lets people use their money in multiple ways, like helping with network security while also supporting decentralized finance (DeFi) projects. It runs on a system called Proof-of-Liquidity (PoL), where users who add money to the network get rewards in a unique way. This blockchain is designed to be compatible with the Ethereum Virtual Machine (EVM), which means it can run the same applications as Ethereum without needing any changes.

Berachain has its own set of tokens for different purposes, like one for paying transaction fees and another for governance (decision-making). It’s currently in a testing phase and is expected to launch fully in 2024.

Key Takeaways

- Layer 1 Blockchain: Berachain is a primary blockchain (not built on top of another network) created using the Cosmos SDK, a set of tools to make secure, scalable blockchains.

- Proof-of-Liquidity (PoL): Unlike other blockchains, which require tokens to be locked up for security, Berachain rewards users who provide liquidity (basically, funds) to support network activities.

- Two Main Tokens: Berachain uses two main tokens:

- BERA: A token used for transaction fees.

- BGT (Berachain Governance Token): A token used to vote on changes to the network. This token is “soulbound,” meaning it cannot be transferred or sold.

- Fast and Cheap Transactions: Berachain aims to make transactions quick and affordable for users.

- Expected Launch: It’s set to go live for everyone in 2024.

What Makes Berachain Different?

Most blockchains use a system called Proof-of-Stake (PoS) to keep the network secure. In PoS, people called validators lock up (or “stake”) their tokens to help confirm transactions. However, this process locks away a lot of tokens, which reduces liquidity (how easily assets can be used).

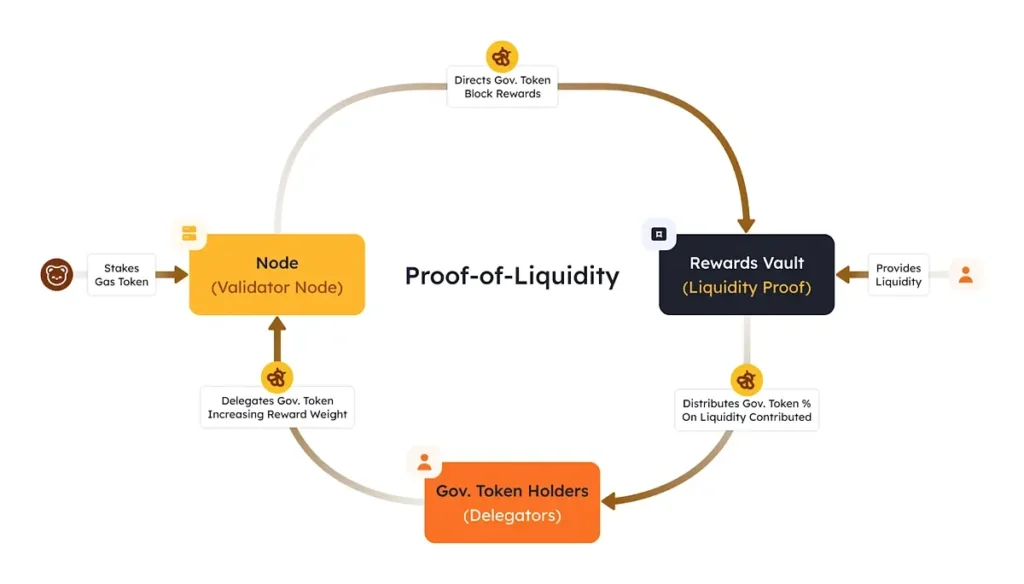

Berachain uses a different approach, called Proof-of-Liquidity (PoL), to solve this problem. Instead of locking tokens for security, Berachain encourages users to add liquidity to the network. This way, users can keep using their assets while still helping secure the network.

In June 2024, Berachain announced a new version of its test network, showing that it’s getting closer to launching its main network.

How Does Proof-of-Liquidity Work?

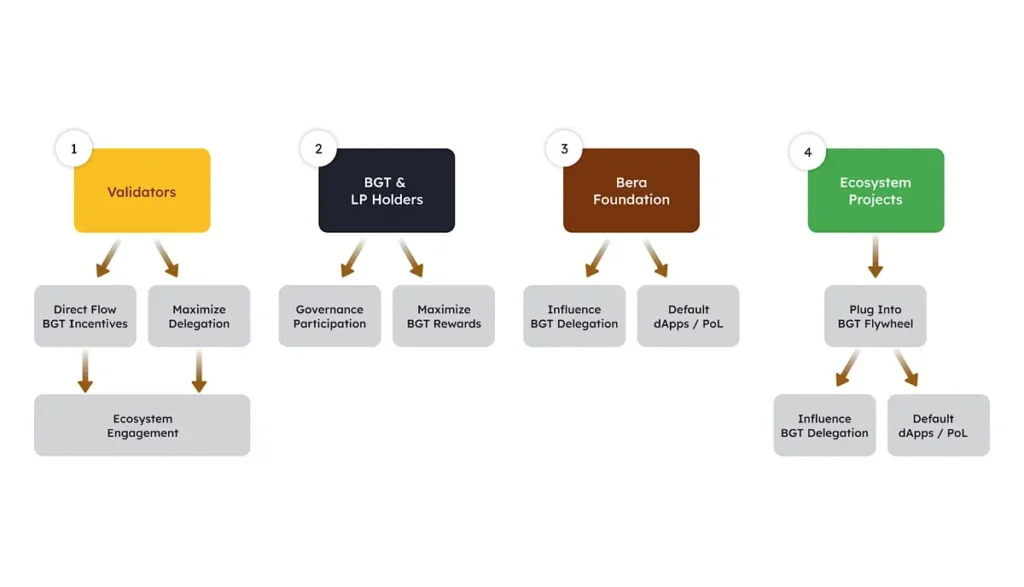

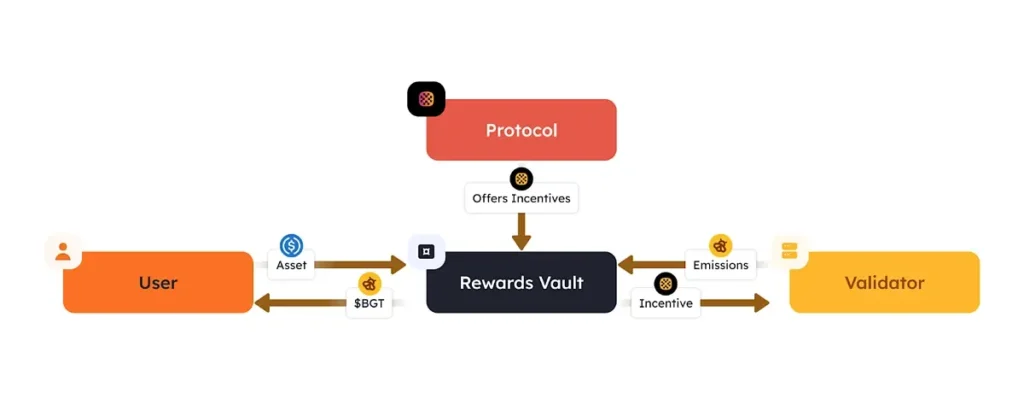

- Providing Liquidity and Earning Rewards: Users who add assets (like tokens) to the network get rewarded with BGT, the governance token. The more assets someone provides, the more rewards they can earn.

- Reward Vaults: Berachain has special places called reward vaults where users can “stake” (deposit) their tokens. When users add assets to these vaults, they receive BGT tokens as a reward. This is different from PoS, where only validators earn rewards directly.

- Applications on Berachain: Since Berachain is EVM-compatible, any app that works on Ethereum can work on Berachain. This feature allows developers to bring their Ethereum-based applications to Berachain without any changes.

A Look at Berachain’s Funding

Berachain started as an NFT project called BongBears in 2021, with a fun bear theme that continues today. Even the team members go by bear-themed names, like “Smokey the Bear.”

The project has raised significant money from investors:

- In 2023, it raised $42 million, led by Polychain Capital.

- In 2024, it raised an additional $100 million, supported by various investors, including Framework Ventures and others.

Berachain’s Structure and Functionality

Berachain is designed to be fast, scalable, and easy to use. It has two main parts: the execution layer and the consensus layer.

- Execution Layer: This part of Berachain is identical to Ethereum’s execution environment, meaning it can run Ethereum applications as they are. This also means that whenever Ethereum gets an upgrade, Berachain can quickly adopt it.

- Consensus Layer with Proof-of-Liquidity (PoL): Unlike traditional blockchains that use PoS, Berachain’s PoL system is designed to maximize liquidity. Instead of locking away tokens, it uses a multi-token approach to keep assets active on the network.

The Tokens in Berachain’s Ecosystem

Berachain has a few different tokens that serve specific purposes:

- BERA: This is the main token for transaction fees. If someone wants to make a transaction on Berachain, they use BERA to pay for it.

- BGT (Berachain Governance Token): BGT is the governance token, which means it gives holders the right to vote on changes in the network. It’s soulbound, meaning it can’t be transferred or sold. BGT can be earned by staking BERA tokens in the reward vaults.

- HONEY: HONEY is the stablecoin on Berachain, which means its value stays stable (tied to the US dollar). Users can mint (create) HONEY by depositing other stablecoins. This token can be used for DeFi activities, like lending and trading, within the Berachain network.

Key Applications on Berachain

Berachain already has several applications in development that showcase what’s possible on the network:

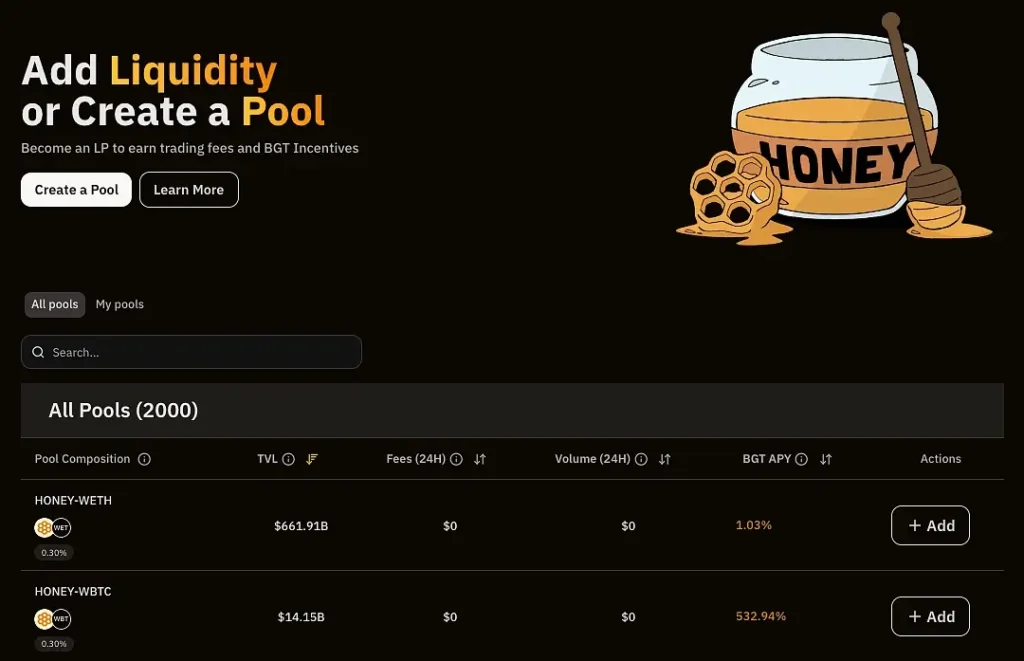

BEX (Berachain Exchange): BEX is Berachain’s decentralized exchange (DEX). Here, users can trade tokens without needing a middleman. Some unique features of BEX include:

Low Fees: Trading on BEX will have low gas fees, making it affordable.

Gasless Transactions: Users can pay for transactions with the token they’re trading, instead of using BERA.

Account Abstraction: Users can set up off-chain transactions, saving on transaction fees.

BEND (Berachain Lending Platform): BEND is a lending and borrowing platform where users can take out loans using HONEY. Borrowers who take loans in HONEY can earn BGT as an incentive. This encourages more people to use HONEY in the network.

BERP (Berachain Perpetual Trading Platform): BERP allows users to trade on the Berachain network, with HONEY as the base token. Liquidity providers can deposit HONEY in the Berp Vault, which is then borrowed by traders.

Why Berachain Might Be Important for the Future of Blockchain

The Proof-of-Liquidity system could make Berachain an attractive choice for people who want a blockchain that doesn’t require locking up assets to provide security. This approach could bring more liquidity to the network, which is crucial for DeFi applications that rely on having accessible funds.

Final Thoughts

Berachain is still in its testing phase, and the team is working hard to bring the project to the public in 2024. By introducing Proof-of-Liquidity, Berachain aims to provide a fresh take on blockchain security and liquidity. If it proves successful, Berachain could attract a wide range of users and developers looking for a blockchain that balances security with liquidity.

However, anyone interested in Berachain should always do their own research before using or investing in the network. Remember, this article is just for information and education and shouldn’t be taken as financial advice.