On Thursday, November 7, the U.S. Federal Reserve, led by Chairman Jerome Powell, decided to lower interest rates by 0.25%. Now, the rates range between 4.50% and 4.75%. This is the second time since 2020 that the Federal Reserve has cut interest rates. The goal is to keep inflation under control and keep the economy steady.

Why Did the Federal Reserve Cut Rates?

Jerome Powell, the head of the Federal Reserve, decided to lower the rates after looking at the country’s economic data. The data shows that while the U.S. economy is still growing, it is not growing as fast as before. Powell said that, overall, the U.S. economy is still strong and should keep growing. He explained that the Federal Reserve is trying to bring inflation down to 2%. However, they want to do this without making unemployment rise too much, which can happen when inflation falls too quickly.

Bank of England Also Lowers Rates

Just a few hours before the Federal Reserve’s announcement, the Bank of England (BoE) also cut its interest rates by 0.25%. This change brings their rates to 4.75%. The BoE expects inflation in the U.K. to drop to 2.75% by mid-2025 and to go as low as 1.8% by 2027. After the rate cut, the value of the British pound rose by 0.5%.

How Did the Markets React?

After the interest rate cut, the price of gold fell. Gold had reached a record high of $2,705 per ounce but later dropped to around $2,691 per ounce. On the other hand, the stock market performed well. Stock prices hit record highs due to news of Donald Trump’s re-election as president.

The S&P 500, a major stock index, increased by 0.7%, while the Nasdaq 100 climbed by 1.5%. The Dow Jones did not change much but still reached a new high. Overall, it was the second day in a row that these indices broke records. The U.S. dollar index, known as DXY, stayed close to 104.50.

What Does the Federal Reserve Expect in the Future?

Looking ahead, the Federal Reserve thinks that interest rates may keep going down over the next few years. They predict that by the end of this year, rates could fall to around 4.25%. By 2026, they might go as low as 2.75% to 3%. However, Jerome Powell made it clear that each decision about rates will depend on how the economy is doing at that moment. So, people shouldn’t assume that rate cuts will always happen in a predictable way.

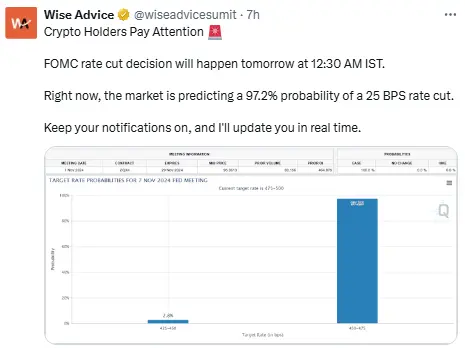

Almost everyone expected the Federal Reserve to lower rates by at least 0.25% at this meeting. Some thought there was a small chance of a larger cut, but that didn’t happen. The markets have been performing well this year, mainly because people believe that lower rates are coming and there are signs that the job market is cooling down a bit.

Bitcoin and Cryptocurrency Market

The U.S. market for cryptocurrencies has been getting a lot of attention. Many believe that with Donald Trump back as president, Bitcoin and other cryptocurrencies will do well. There is talk that Bitcoin could even reach $100,000 soon, especially if the U.S. Securities and Exchange Commission (SEC) head Gary Gensler steps down.

At the moment, Bitcoin is trading at around $75,899. This is slightly lower than its all-time high of $76,849. If the price of Bitcoin goes below $69,000, it could fall further to around $65,000 or $62,000. But if it closes above its resistance level of $76,292, it could rise to between $80,500 and $90,000.

The entire cryptocurrency market is worth $2.67 trillion. Bitcoin makes up a big part of this market, with a dominance rate of about 56.2%. After Donald Trump’s victory was announced, other smaller cryptocurrencies (known as altcoins) saw their prices rise by 5% to 20%. The second-largest cryptocurrency, Ethereum, is now trading close to $2,886.

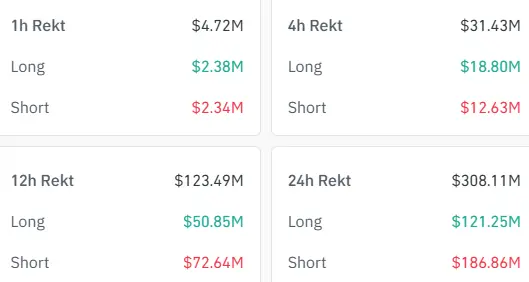

The recent jump in Bitcoin’s price led to a large number of traders losing money. About $308 million was lost, mainly from people betting against Bitcoin’s rise.

Final Thoughts

The Federal Reserve’s recent rate cut is part of their effort to keep inflation under control and support the economy. People in the market are watching closely to see what happens next with interest rates. The changes in rates will depend on how the economy is doing in the future.

Even though there have been big changes in the markets recently, experts say that more ups and downs are likely. While short-term price corrections could happen, many believe that cryptocurrencies like Bitcoin could keep doing well, especially if there is clearer regulation during Donald Trump’s time in office.