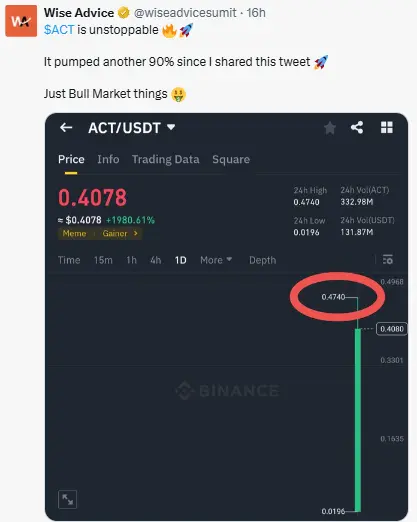

On November 11, the world’s largest cryptocurrency exchange, Binance, added two new meme coins for trading: ACT I: The AI Prophecy (ACT) and Peanut the Squirrel (PNUT). This announcement created a big excitement in the crypto market. Right after this news, the prices of both tokens increased a lot. ACT’s value went up by more than 2500%, while PNUT’s price grew by 250%.

ACT and PNUT Prices Skyrocketed After Listing

The token ACT I: The AI Prophecy, also called ACT, saw its market value grow by a huge 2500%. It reached a market value of $568 million. This token works on the Solana blockchain and is currently being traded at $0.58 per token. After Binance announced it, the token’s price had a big spike, which is sometimes called a “God Candle” in the crypto world.

According to its official website, ACT stands for AI Community Token. It is a meme coin that wants to create a community focused on artificial intelligence (AI) research, education, and working together.

In the same way, the meme coin PNUT, which is based on a famous internet squirrel wearing a cowboy hat, also became more valuable after being listed on Binance. After this big announcement, PNUT’s market value went up by 250% and reached $436 million. Currently, each PNUT token is being traded at $0.43.

PNUT is linked to a popular story about an internet-famous squirrel named Peanut. Peanut was saved by a man named Mark Longo after a car accident that sadly took the life of the squirrel’s mother. Mark made Peanut famous by sharing his adventures on Instagram, along with Peanut’s raccoon friend named Fred. The story became well-known and got the attention of many people, including animal rights groups and even Elon Musk.

Most new meme coins focus on animals, like MOODENG, NEIRO, and PNUT. Recently, another meme coin called NEIRO experienced a big growth, with its market value increasing by 7000% soon after it was listed on Binance.

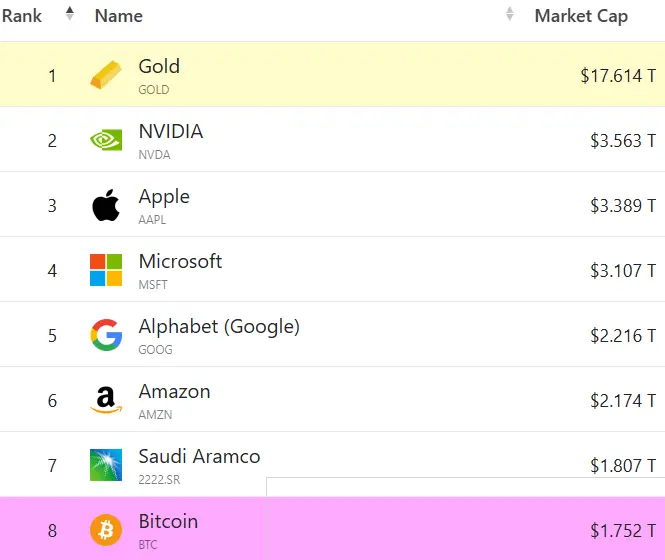

Bitcoin Reaches New Heights and Beats Silver Market Cap

Bitcoin, the most well-known cryptocurrency, recently hit a new high price of almost $90,000. This also pushed Bitcoin to achieve an important milestone by becoming more valuable than silver. Its market value now stands at $1.732 trillion, making it the 8th most valuable asset in the world.

Bitcoin’s price went up a lot, climbing above $89,000 in a single day. This rise helped it beat silver’s total market value. Since Donald Trump won the U.S. presidential election on November 6, Bitcoin’s price has gone up by about 25%.

With this new increase in value, Bitcoin is now just behind the world’s biggest assets like gold, Nvidia, Apple, Microsoft, Google, Amazon, and Saudi Aramco in terms of market size.

Ripple Effect: Other Cryptocurrencies Join the Rally

As Bitcoin’s value rose, it created a ripple effect, causing the values of many other cryptocurrencies to rise too. Some even reached new record highs or got close to it, thanks to the momentum from Bitcoin’s rise.

Dogecoin (DOGE), a meme coin that has been supported by billionaire Elon Musk, saw a big price increase after the U.S. election results. Musk’s involvement in the new Trump administration has sparked new interest in Dogecoin. Currently, DOGE is trading at $0.35, which is 20% higher than it was just a day ago. This is also its highest price since 2021. Over the last week, DOGE’s value has gone up by 121%, and over the past month, it has nearly doubled with a 190% rise.

Ethereum (ETH), the second most popular cryptocurrency after Bitcoin, has also been doing well. In the last 24 hours, it rose by 3.5% and reached $3,387, its highest level since August 3rd of this year.

Solana (SOL), another major cryptocurrency, also hit a new high, reaching $224, its highest point since December 2021. The total value of all Solana tokens combined is now a record-breaking $104 billion.

Impact on the Overall Market

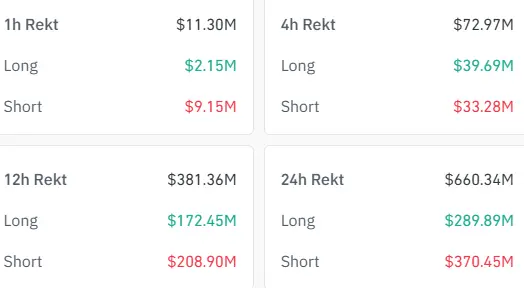

The increase in Bitcoin’s value has caused many short traders to lose money. When the price of a cryptocurrency rises quickly, traders who bet on its value going down can be “liquidated,” meaning their trades are forced to close at a loss. Over the past day, total liquidations reached $660.34 million, with most of that—$370.45 million—coming from short trades. In the past 24 hours alone, 174,662 traders had their positions closed.

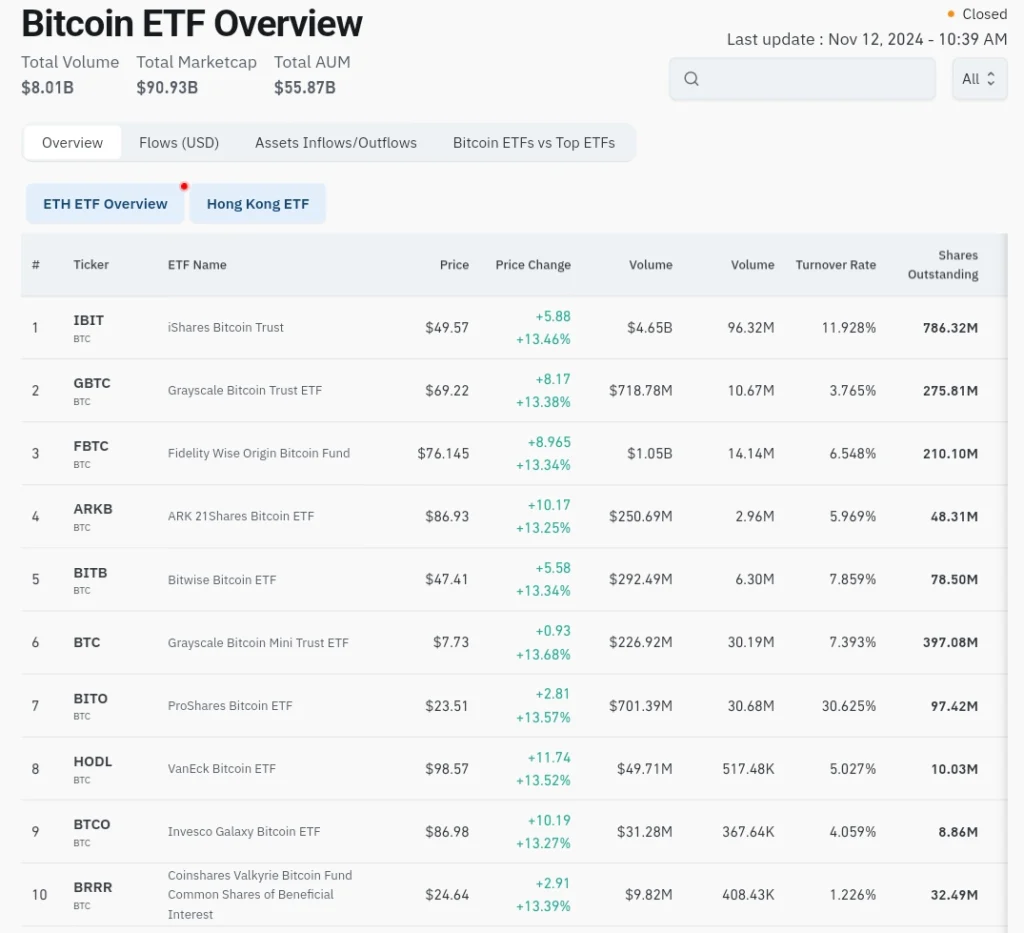

Experts believe that Bitcoin’s recent rise is mainly due to Trump’s election win, which has led many large institutions to buy Bitcoin. Additionally, Bitcoin-based exchange-traded funds (ETFs) have also been doing well, adding to the excitement.

In the American stock market, companies related to cryptocurrency have also seen big gains. MicroStrategy (MSTR), a company known for holding large amounts of Bitcoin, reached a record price of $340.31 per share. This marked its highest price in nearly 25 years, with a 24.5% increase. Similarly, the stock of Coinbase (COIN), a major crypto exchange, rose by 22.1% in one day, reaching $330.59. This is the first time Coinbase’s stock has gone above $300 since November 2021.

On November 11, U.S.-based Bitcoin ETFs had a total trading volume of around $8 billion, which was the highest since March of this year. BlackRock’s iShares Bitcoin Trust (IBIT) alone saw $4.5 billion in trades. When combining the trading volume of Bitcoin ETFs, MicroStrategy, and Coinbase, the total trading volume hit a record of $38 billion.

Conclusion

The recent increase in Bitcoin’s value is connected to Trump’s win in the U.S. election. Many people think his positive views on cryptocurrencies could lead to better regulations and more support for digital currencies. If this strong trend continues, experts believe Bitcoin could reach the milestone of $100,000 by the end of 2024.