Last week, something big happened in the world of cryptocurrencies. The SEC, which is a group in the U.S. that makes sure trading and money rules are followed, made a surprising decision. They said it is okay to trade options for Bitcoin exchange-traded funds (ETFs). This news surprised many people in the cryptocurrency market.

What Does the SEC’s Decision Mean?

Now that the SEC has given the green light, investors have more ways to invest in Bitcoin. Bitcoin is a very popular type of cryptocurrency, and exchange-traded funds (ETFs) are a kind of investment product. ETFs are like baskets of assets (such as stocks or Bitcoin) that people can buy and sell. But now, with the new approval, investors can also trade options for Bitcoin ETFs.

Options are special contracts that allow people to buy or sell something at a set price before a certain date. If the price changes in a way that helps them, they can make a good profit. If not, they can choose not to buy or sell. This kind of flexibility could make more investors, especially big companies, interested in Bitcoin ETFs.

Why is This Important?

Before this, people could already invest in Bitcoin ETFs, but they didn’t have the choice of options trading with them. With this new opportunity, the way people trade Bitcoin could change. Now, big companies and financial institutions might want to get involved. When more big investors come in, it could help make the market less risky and more stable. The crypto market is often known for its big ups and downs, so any stability is good news for some traders.

Bitcoin ETF Options Will Attract More Investors

Two major trading groups, the New York Stock Exchange (NYSE) and the Chicago Board Options Exchange (CBOE), have been allowed to offer options for several Bitcoin Spot ETFs.

The NYSE is going to offer options for some Bitcoin products, including:

- The Grayscale Bitcoin Trust (GBTC)

- The Grayscale Mini Trust (BTC)

- The Bitwise Bitcoin ETF (BITB)

Meanwhile, the CBOE will list options for:

- Fidelity Wise Origin Bitcoin Fund (FBTC)

- ARK 21Shares Bitcoin ETF (ARKB)

What is Options Trading?

Let’s make options trading even simpler to understand. Think of it as a choice or a bet. When you buy an option, you are betting that the price of something will go up or down before a certain date. You do not have to go through with the trade if you don’t want to; you can walk away if things don’t look good. It’s like reserving a chance to make a trade, but with less risk involved.

For example, let’s say you buy an option for a Bitcoin ETF, betting that its price will go up. If the price rises, you can buy the ETF at the lower price that you reserved and then sell it at the new higher price to make money. If the price doesn’t go up or drops, you don’t have to buy it and can simply lose only the small amount you paid for the option.

This kind of trading is very popular in regular stock markets, and now it’s coming to Bitcoin ETFs. This could make more people want to invest because they have more control over their trades.

Why Institutions Like Options Trading

Big financial institutions, such as banks and investment firms, like options because they can use them to protect themselves from big losses. The cryptocurrency market is known for being very unpredictable, with prices often changing very quickly. With options, these institutions can handle the changes better and reduce risks.

Some experts think that allowing options trading on Bitcoin ETFs could make the cryptocurrency market more like the traditional stock market. It could also make the market more liquid, meaning there will be more buying and selling happening, which can be a good thing.

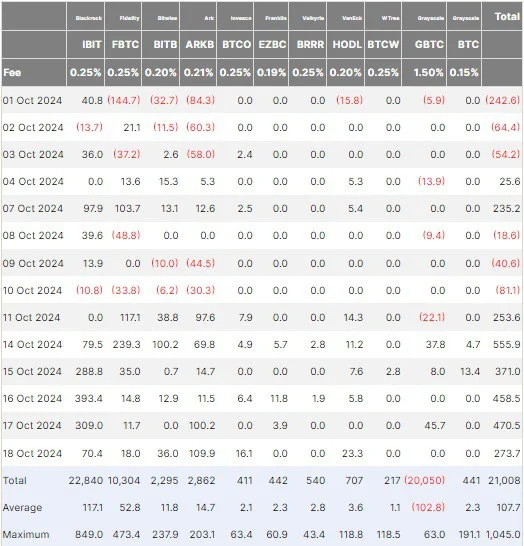

Bitcoin ETFs Reach $21 Billion in Inflows

Bitcoin ETFs have been doing really well lately. Last Friday, Bitcoin ETFs in the U.S. reached a total of $21 billion in net inflows, which means people have invested that much money in them. This is a huge amount of money, and it shows that investors are very interested in Bitcoin ETFs.

In fact, over $2 billion was invested in Bitcoin ETFs in just one week. To give some perspective, it took gold ETFs five years to reach this same level of interest, but Bitcoin ETFs did it much faster. This makes Bitcoin ETFs the most successful ETFs in history.

Big Investments in Bitcoin ETFs

On Friday alone, about $273 million was invested in Bitcoin ETFs. One of the most popular ETFs was ARK Invest’s ARKB, which saw nearly $110 million in new investments. Another big ETF, BlackRock’s IBIT, also saw an increase of over $70 million. Other popular funds like VanEck’s HODL, Bitwise’s BITB, and Fidelity’s FBTC also got large amounts of new money invested.

The ARKB and IBIT ETFs were the most successful Bitcoin ETFs over the past week. ARKB saw more than $100 million in new investments on both Thursday and Friday. Even the Grayscale Bitcoin Trust (GBTC), which often saw investors pulling out money, had a positive week with over $91 million coming in.

Bitcoin’s Growing Dominance

The value of Bitcoin has been going up quickly in recent weeks. At one point, its price reached $69,000, which is very close to its all-time high. As Bitcoin’s price rises, its “dominance” in the cryptocurrency market also increases. Dominance means how much of the total market value is made up of Bitcoin compared to other cryptocurrencies.

Recently, Bitcoin’s dominance has gone up from 57.50% to 58.50%. When Bitcoin is doing really well, other cryptocurrencies (called altcoins) often don’t perform as well. Right now, the total value of all cryptocurrencies is about $2.44 trillion, and Bitcoin’s market cap is $1.34 trillion.

What’s Affecting Bitcoin’s Price?

Several things are causing Bitcoin’s price to rise. One factor is the recent decision by the U.S. government to lower interest rates. Lower rates can make investments like Bitcoin more attractive. Also, news from China about financial support for the economy has helped boost the entire cryptocurrency market. Even news like Donald Trump’s campaign receiving $7.5 million in Bitcoin donations has made an impact.

However, while Bitcoin is doing well now, some people think a pullback might be coming. This means the price could drop temporarily before going up again. Bitcoin is currently close to hitting a resistance level of $69,000. If it can break through this level, experts say it could continue rising and trade between $70,000 and $75,000.

Final Thoughts

With the approval of Bitcoin ETF options, more big investors might enter the crypto market. Both regular and large-scale investors are showing interest in options trading. The rise in Bitcoin’s price and its growing dominance have traders feeling both hopeful and cautious. Some expect the good times to continue, while others are preparing for a possible drop in prices.

No matter what, it’s important to do your own research and understand the risks before making any investment decisions. The cryptocurrency market can be unpredictable, so being informed is key.