After Donald Trump won the recent U.S. election, Bitcoin’s price has skyrocketed. It hit an all-time high of nearly $80,000, increasing by 16% over the past week. Right now, there is a lot of focus on choosing a new leader for the U.S. Securities and Exchange Commission (SEC). Many people think Trump’s team wants someone in charge who likes and supports digital money like Bitcoin and other cryptocurrencies. This could mean important changes for the crypto industry.

Who Will Lead the SEC Next?

There hasn’t been a final decision on who will lead the SEC, but it seems clear that Trump’s team wants someone who will support the growth and innovation of digital money. There are big questions about who the top candidates are and whether Gary Gensler, the current SEC Chair, will resign before Trump officially takes over in January.

Will Gary Gensler Resign?

During his 2024 campaign, Trump promised to remove SEC Chair Gary Gensler as soon as he became president again. Gensler has been a controversial figure in the world of digital assets because he has been very strict with cryptocurrency regulations. Trump’s pledge to replace him with someone who likes crypto more could lead to major changes for the industry.

President Joe Biden picked Gensler in 2021. Since then, Gensler has taken strong action to regulate cryptocurrencies, including suing several well-known crypto exchanges and businesses. Even though Gensler’s term doesn’t end until 2026, there are rumors that he might be forced to leave when Trump takes office. For now, Gensler hasn’t said if he plans to stay or leave.

Who Could Be the Next SEC Chair?

There are a few names being mentioned as possible replacements for Gary Gensler. The two top candidates are Dan Gallagher and Richard Farley, who both have positive views about cryptocurrencies.

Dan Gallagher

Gallagher used to be a commissioner at the SEC from 2011 to 2015. He believes that new financial technologies, like cryptocurrencies, need better and clearer rules. His opinion is different from Gensler’s strict approach. If Gallagher becomes the new SEC Chair, he could create new rules that help crypto companies follow the law more easily. He has talked about creating “baseline registration systems” for crypto exchanges, which would give these businesses a clear path to follow and make it easier for them to grow and attract investors in the U.S.

Richard Farley

Farley has a lot of experience in finance, especially with banks and other financial companies. He is well-connected in politics too. His wife, Chele Farley, has worked as the finance head for the Republican party in New York City and has even run for political office as a Republican. Farley also has close ties with Robert F. Kennedy Jr., who supports Trump and might join his government. If Farley becomes the SEC Chair, he could help create a more favorable environment for cryptocurrencies.

Other Candidates for the Job

Aside from Gallagher and Farley, other possible candidates for the SEC role include Chris Giancarlo, who used to lead the Commodity Futures Trading Commission (CFTC). Giancarlo is often called “CryptoDad” because of his support for digital assets. Another candidate is Hester Peirce, a current SEC Commissioner known for being friendly towards the crypto industry.

Trump’s Positive View on Crypto

During Trump’s previous presidency, new rules were put in place for cryptocurrencies, such as rules for exchanges and stablecoins (a type of cryptocurrency that tries to keep its value stable). Trump’s views on stablecoins and crypto exchanges like Coinbase and Binance could change the rules on how these companies operate in the U.S. If Trump slows down plans for a government digital currency (CBDC), it might make the U.S. crypto market different from other countries that are moving forward with their own digital currencies.

Trump’s support for a plan called the Bitcoin Strategic Reserve has also boosted confidence in the crypto market. He made this promise while campaigning for president.

Bitcoin’s Price Reaches a New High Thanks to Trump’s Win

When Trump started leading the presidential race, Bitcoin’s price shot up to more than $75,000. This was a jump of nearly $8,000. The U.S. Federal Reserve also helped push Bitcoin’s price higher by cutting interest rates to between 4.5% and 4.75%. By Thursday, Bitcoin hit $77,000. On Friday, it stayed around $76,000 but later surged to $77,240. Even after falling back slightly to $76,500, Bitcoin still showed a 10% gain for the week and a 25% rise over the past month. Currently, Bitcoin’s market value is over $1.5 trillion, making it one of the top financial assets in the world.

Other Cryptocurrencies See Gains Too

Bitcoin’s new high has helped lift the entire cryptocurrency market. Ethereum’s price has gone up more than 5% in the past 24 hours and 21% over the week. It is now trading above $3,200 for the first time in months. Solana, another digital currency, has also done well since Trump’s win. Its price has increased by over 21% in just a week, reaching above $200. Binance Coin has risen by 6% to $634. Other cryptocurrencies like Avalanche, Chainlink, Cardano, and NEAR Protocol are also up. Altogether, the total value of the crypto market now stands at $2.84 trillion.

Growing Popularity of Bitcoin ETFs

Since Trump’s reelection, there has been a big increase in investments in Bitcoin exchange-traded funds (ETFs). The BlackRock Bitcoin ETF had a trading volume of $4.1 billion. November 7 was a record day with almost $1.4 billion in net investments. BlackRock led the way with over $1 billion going into its Bitcoin ETF. Fidelity’s Bitcoin ETF also saw $190 million in new investments.

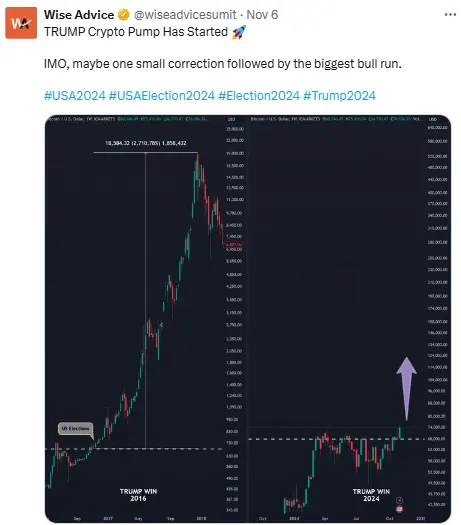

Looking back, the price of Bitcoin was around $700 in November 2016, but by the end of 2017, it had jumped to nearly $20,000. On November 5, 2020, it was worth around $15,500 and then reached almost $69,000 by November 2021. Many experts believe Bitcoin’s price could keep going up and even pass the $100,000 mark in 2024.

Final Thoughts

Experts think that Trump’s second term could be good for the crypto industry. Many fund managers are applying to create ETFs that include other digital currencies like Solana, XRP, and Litecoin. There are even plans for ETFs with a mix of different digital coins.

While it’s uncertain if Bitcoin will hit $100,000, one thing is clear: there is a strong demand for cryptocurrencies. Thanks to Trump’s positive stance on digital money, the future looks bright for Bitcoin and other digital assets.