Donald Trump is very close to winning the 2024 U.S. Presidential Election. Right now, he has 267 votes from the electoral college. To officially win, he needs 270 votes, so he’s only three votes away. He also has 51.1% of all votes, showing he’s in the lead.

If Donald Trump wins, it will be his second time as President of the United States. This victory could affect a lot of things, including the cryptocurrency market. Let’s explore what Trump’s leadership might mean for cryptocurrency.

What is Cryptocurrency, and Why Do People Care?

Cryptocurrency is a type of digital money that doesn’t need banks. The most famous cryptocurrency is Bitcoin, but there are many others, like Ethereum. Unlike regular money, like dollars, cryptocurrency only exists online. People buy it and trade it on special websites called exchanges.

Some people see cryptocurrency as the money of the future. Others see it as a way to invest and earn profits, just like people do with stocks or gold. Cryptocurrencies have been popular for years, but government rules about it are still new and developing.

How Could Donald Trump Affect Cryptocurrency?

If Donald Trump becomes president again, his decisions about money, laws, and relationships with other countries could change the way cryptocurrency works in the United States. When past elections have happened, Bitcoin, the most well-known cryptocurrency, has sometimes gone up in value after the results.

This means that the 2024 election, with Trump in the lead, might affect cryptocurrency prices. Some people think his policies could help the crypto market grow, while others think it could create more risks. Let’s look at how Trump’s views on cryptocurrency have changed.

Donald Trump’s Changing Views on Cryptocurrency

In the past, Donald Trump didn’t seem to like cryptocurrency. He was skeptical and even said it could be dangerous. But recently, he has become more supportive of cryptocurrency and has said he wants the United States to lead in this area.

One thing Trump doesn’t support, however, is the idea of a U.S. central bank digital currency (CBDC). A CBDC would be a digital version of the dollar, managed by the U.S. government, sort of like a cryptocurrency controlled by the government. Trump thinks this is not a good idea and prefers private cryptocurrencies, like Bitcoin, that are not run by the government.

Will Donald Trump Create New Crypto Regulations?

If Trump wins, his government might make some new rules for cryptocurrency, especially for stablecoins and exchanges. Stablecoins are cryptocurrencies that are tied to real-world money, like the U.S. dollar, to keep their value steady. Exchanges, like Coinbase and Binance, are websites where people can buy, sell, and trade cryptocurrencies.

There have been new rules for exchanges and stablecoins in recent years. If Trump becomes president, he could change these rules. For example, he has criticized Gary Gensler, who is the head of the U.S. Securities and Exchange Commission (SEC). The SEC is the agency that sets rules for financial markets. Trump has said he doesn’t like how Gensler is managing the crypto industry and might even replace him.

Trump’s choice to support or avoid certain regulations could have a big impact on the crypto market. If he’s more open to crypto, the market could grow. But if he sets strict rules, some companies and investors might lose interest.

What Do Trump’s Economic Policies Mean for Crypto Prices?

Trump’s economic ideas focus on cutting taxes and spending more money on government projects. In his past term, he made policies to boost the economy, which sometimes led to higher inflation. Inflation happens when prices go up, and the value of money goes down. When inflation rises, people often look for other ways to keep their money safe.

Bitcoin, the biggest cryptocurrency, is sometimes called “digital gold” because people see it as a safe place to store wealth, especially when inflation is high. So, if Trump’s policies lead to higher inflation, it’s possible that more people will buy Bitcoin, pushing its price up.

Trump might also encourage the Federal Reserve, the organization that controls U.S. interest rates, to keep rates low. Low interest rates can make investing in cryptocurrency more appealing because people look for other ways to grow their money.

In short, if Trump’s policies lead to more inflation, it could make cryptocurrency more attractive to people who want to protect their wealth. More demand for crypto might lead to higher prices.

Could Trump’s Support Help the U.S. Lead in Blockchain Technology?

Besides cryptocurrency, Trump is interested in blockchain, the technology behind cryptocurrencies. Blockchain is a system that records information in a very secure way, and many experts believe it has the power to improve technology in areas like banking, data security, and even voting.

If Trump promotes blockchain technology, he might encourage companies to develop more projects in the U.S. This could mean more jobs and more innovation in America. For example, more startups might begin in the U.S., creating new uses for blockchain. This support could help the U.S. become a global leader in blockchain and cryptocurrency.

Crypto Donations in the 2024 U.S. Presidential Election

This year, cryptocurrency has also played a role in U.S. politics. Many people in the crypto industry have donated money to candidates who support technology and innovation. In fact, crypto donations for the 2024 U.S. presidential election have exceeded $238 million. This is more than donations from other big industries, like oil or pharmaceuticals.

Donald Trump’s chances of winning are high on Polymarket, a website where people bet on election outcomes. His odds went up to 99.4%, showing that many people think he will win.

If Trump wins, some experts believe his presidency could lead to more interest in cryptocurrencies in the U.S.

How Has Bitcoin Performed in Previous Election Years?

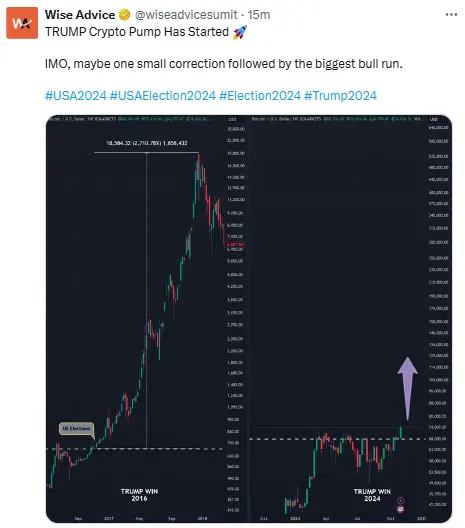

In past U.S. elections, Bitcoin’s price has often gone up after the results were announced. For example, in 2016, Bitcoin’s price rose significantly after Trump’s victory. Bitcoin’s price was around $700 per coin during the election in November 2016, but by the end of 2017, it was close to $20,000.

A similar pattern happened in 2020. When the election took place, Bitcoin was around $15,500 per coin. About a year later, it reached nearly $69,000. This shows that Bitcoin can have a “bull run,” or big increase in price, after major events like elections.

Right now, Bitcoin’s price is around $73,000. If Trump wins, some experts think Bitcoin’s price could go even higher and might even reach $100,000. The current cryptocurrency market is valued at about $2.53 trillion, and Bitcoin makes up a big part of that value.

Final Thoughts

If Donald Trump becomes president, his ideas about taxes, spending, and technology could shape the future of cryptocurrency in the U.S. Trump has been known to support policies that encourage economic growth and job creation. However, the cryptocurrency industry is more complex now than it was during his first term. The market might react strongly to news about his policies.

Many experts believe that the crypto market will have ups and downs in the coming days as people adjust to Trump’s leadership. But Trump’s victory, along with potential interest rate changes, could boost the crypto market in the long run.

In conclusion, Trump’s presidency might lead to more opportunities for cryptocurrency growth. But with so many factors involved, it’s hard to predict exactly what will happen.