Recently, Bitcoin has been on an exciting journey. Its price has gone above $73,000, nearing its all-time high. This rise has led to big financial shifts, with over $260 million in losses for people who were betting against it. Many experts now believe that Bitcoin could be entering a new “bull market”—a time when prices keep going up.

This sudden positive vibe around Bitcoin has raised questions. Why is this happening now? Is there more to this excitement than just people wanting to see their investments grow? Let’s break down the factors that could be leading to this upward trend in Bitcoin and other cryptocurrencies.

1. More Money Flowing Globally: A Big Boost for Bitcoin

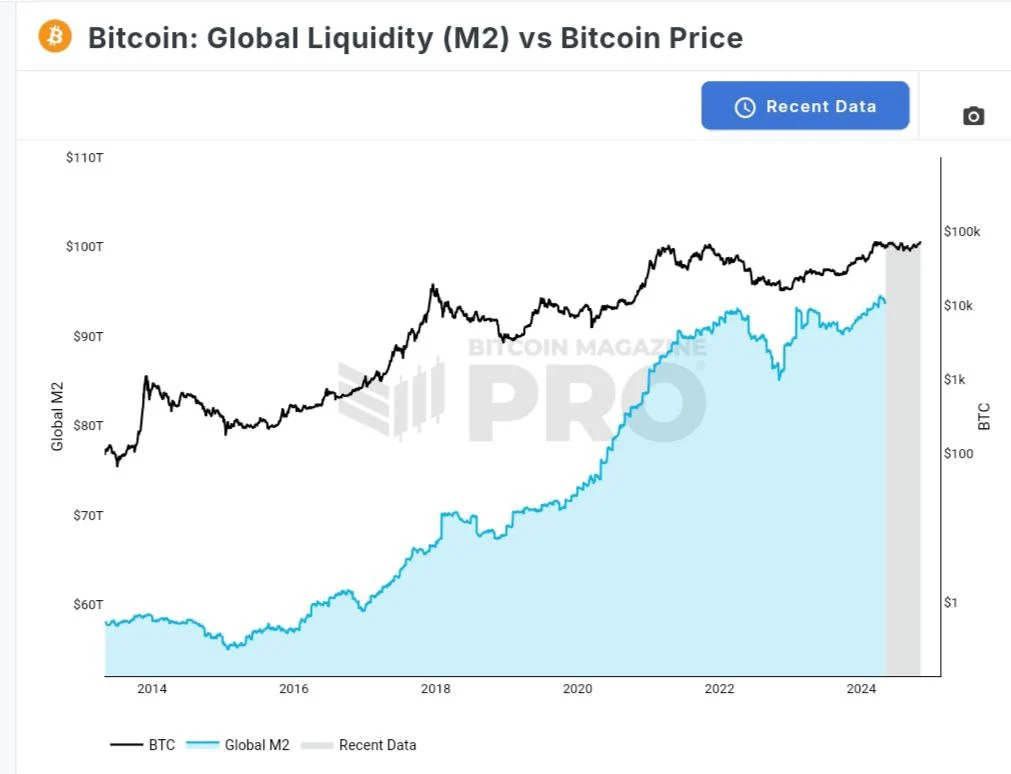

Every time Bitcoin prices go up significantly, there’s usually a common reason: a big increase in global money flow, or “global liquidity.” But what is global liquidity? In simple terms, it’s when there’s a lot of money in the world ready to be invested. When more money is available, people are more willing to invest in risky things like stocks, real estate, and, of course, cryptocurrencies like Bitcoin.

Bitcoin often rises when global liquidity increases. For instance, when central banks (like the U.S. Federal Reserve) lower interest rates or make it easier to borrow money, this adds more money to the economy. With more cash circulating, people tend to invest in assets, including Bitcoin, hoping to get a good return.

2. China’s Role in the Bitcoin Boom

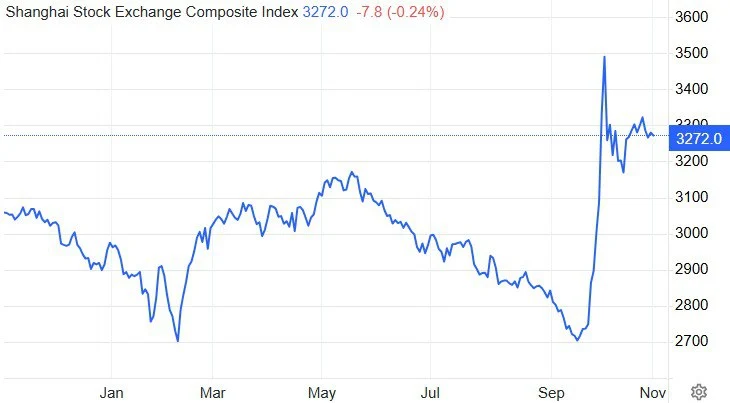

China has been playing a big part in the current global money flow. Recently, the Chinese government announced a new plan to boost its economy with a huge financial package. This means they are adding more money into their economy to encourage growth. When economies get this kind of financial boost, it can lead to optimism, and investors start looking at high-risk assets like Bitcoin.

If China’s plan goes through, they will inject around $1.4 trillion into the economy. This would be one of the largest economic boosts the world has seen in recent years. As China’s economy picks up, other countries may follow their example, leading to more global money flow that could keep pushing Bitcoin up.

3. The Influence of Big Institutions and Investors

Bitcoin used to be mainly popular among small investors, but now big institutions, like banks and investment companies, are getting involved. Wall Street, with firms like BlackRock (one of the world’s largest asset management companies), is showing interest in Bitcoin. Why? Many believe that cryptocurrency, especially Bitcoin, could become a major part of the future financial system.

With more big players buying into Bitcoin, it adds a sense of security for smaller investors. When these large institutions show confidence in Bitcoin, it reassures the market that Bitcoin could be here to stay.

4. The U.S. Federal Reserve’s Role

Another important factor is the U.S. Federal Reserve (often just called “the Fed”). The Fed controls interest rates, which have a big impact on the economy. When interest rates are low, people can borrow money cheaply, leading to more investments in assets like Bitcoin. Recently, the Fed has been less strict about keeping interest rates high. This approach, called a “dovish stance,” has created a favorable environment for Bitcoin.

If the Fed continues with this approach, it may encourage more investment in Bitcoin, especially from large institutions looking for alternative assets to protect their money from inflation (the rising prices of goods and services).

5. The U.S. Elections and Global Politics

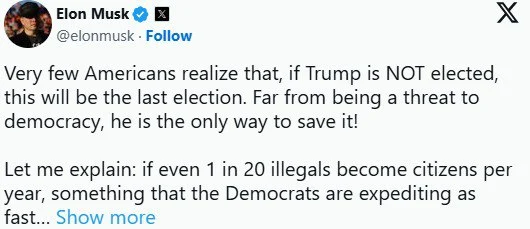

Political events also have an impact on Bitcoin. The United States will soon have a presidential election, which could create uncertainty in the financial markets. Some experts believe that this kind of uncertainty could push more people to invest in Bitcoin as a way to protect their money. If, for example, former President Donald Trump returns to office, some people think it could bring a more positive outlook for Bitcoin.

Also, beyond the U.S., other countries are showing interest in Bitcoin. For instance, Bhutan and El Salvador have started investing in Bitcoin and even set up Bitcoin mining operations (the process of verifying Bitcoin transactions). Bhutan holds around $800 million in Bitcoin, while El Salvador has made Bitcoin a legal currency in their country. If more countries follow this trend, the demand for Bitcoin could continue to rise.

6. Bitcoin Leading, Altcoins Following

Bitcoin often sets the pace for other cryptocurrencies, known as altcoins. In 2024, many altcoins have struggled, while Bitcoin has surged. But there’s a pattern in the crypto world: when Bitcoin goes up, altcoins often follow. This period, when altcoins start rising after Bitcoin, is called an “alt season.”

Experts expect this pattern might happen again. First, Bitcoin rises, then money flows into altcoins, giving them a boost. However, the arrival of Bitcoin Exchange-Traded Funds (ETFs) could change this slightly. ETFs make it easier for people to invest in Bitcoin without actually owning it, which might keep more money tied up in Bitcoin. Still, many think that altcoins will eventually catch up as more investors look to diversify their portfolios.

7. The Big Liquidation Event

Bitcoin’s recent price rise to around $73,000 has led to a major liquidation event. This means that a lot of people who were betting against Bitcoin, thinking its price would go down, had to sell their positions, losing a lot of money. This liquidation totaled more than $260 million and mostly took place on big crypto exchanges like Binance and OKX.

When a lot of people lose these types of bets, it often strengthens the upward trend in Bitcoin. This is because the market interprets it as a sign that there are more people willing to invest in Bitcoin for the long term, creating a self-reinforcing cycle of growth.

What’s Next for Bitcoin? A Look into the Future

Looking forward, many experts are predicting that Bitcoin could continue its upward journey, with some even forecasting it could reach $120,000 by early 2025. For this to happen, Bitcoin needs to stay above important price levels, like $69,000. Currently, with Bitcoin around $73,000, many believe this could be the beginning of a prolonged bull market, one that could bring Bitcoin closer to six figures.

However, Bitcoin’s future isn’t just about predictions. Its price will depend on global economic factors like China’s economic stimulus, U.S. interest rates, and political events. If these factors continue to be favorable, Bitcoin could indeed see more significant gains.

Conclusion: Why This Could Be Bitcoin’s Biggest Bull Run Yet

Bitcoin’s recent surge has sparked hope among many crypto investors. But this growth isn’t just based on excitement—it’s tied to important economic and global events. The rise in global liquidity, led by China’s financial boost, and the involvement of big institutions, along with political factors, have created a positive outlook for Bitcoin.

As more people buy into the idea of Bitcoin as a long-term investment, its price might keep going up. If the global economic environment remains favorable, and with the support of institutions and possibly even governments, Bitcoin’s journey to new heights could continue well into 2025. For now, all eyes are on Bitcoin as it flirts with its all-time high and looks to cement its place as a valuable part of the financial world.