Hyperinflation happens when the prices of goods and services increase extremely fast. It’s when a country’s money loses its value quickly, making everyday items super expensive. Countries like Venezuela and Argentina have faced this problem, causing their people to struggle with rising costs and money that doesn’t hold its worth.

While traditional fixes like price controls and changing the currency might not work well, some people have started turning to cryptocurrencies like Bitcoin and stablecoins as alternatives. These digital currencies could help protect against hyperinflation’s worst effects. Bitcoin, for example, isn’t controlled by any government, and stablecoins are linked to strong currencies like the US dollar. But the big question remains: Can cryptocurrencies truly solve the problems of economies struggling with hyperinflation?

Causes and Effects of Hyperinflation

Hyperinflation is a severe form of inflation where prices keep going up quickly, causing money to lose its worth. This creates chaos and can lead to the breakdown of social order. Many reasons contribute to hyperinflation, including political problems, poor economic decisions, and governments printing too much money. When people lose faith in their government and the currency, hyperinflation can spiral out of control.

In 2024, Venezuela continued to experience hyperinflation, although not as bad as it was in 2018. But still, it’s a tough time for Venezuelans, whose economy depends on oil exports and whose government policies haven’t been able to stabilize the currency or economy. Zimbabwe also faces severe inflation, nearing 600% in 2024, despite efforts to control money supply. When a country reaches this level of inflation, people start looking for alternative ways to hold their savings, like using foreign currencies, valuable assets, or cryptocurrencies.

Stages of Hyperinflation

Hyperinflation often follows a pattern of three stages:

- First Stage: Building Inflation

This stage starts with high government debt and spending. Inflation may be between 10% and 50% per year. At this stage, it might still be possible to fix the economy with the right changes. Argentina experienced this in the early 2000s when it defaulted on its debt and ended its currency’s peg to the US dollar. - Second Stage: Inflation Gets Faster

As economic problems worsen, the government may print more money to try to fix things, but this usually makes inflation much worse, sometimes reaching above 50% per year. Venezuela saw this between 2014 and 2017, and Zimbabwe faced similar issues in the 2000s. People stop trusting the local currency and turn to foreign currencies or assets that hold their value better. - Third Stage: Full-Blown Hyperinflation

When inflation passes 50% per month, the situation becomes critical. In 2018, Venezuela reached this stage, with prices doubling every 26 days. In Zimbabwe, inflation reached 600% in 2024, and people began relying on foreign currencies or cryptocurrencies.

Impact of Hyperinflation

Hyperinflation has major social and economic impacts. In Venezuela, basic items have become so expensive that many people can’t afford food. By October 2024, the minimum wage was under $10 a month, forcing most people to survive on very low incomes. Argentina’s inflation has reduced people’s savings, with nearly 40% of the population living in poverty. In Zimbabwe, the cost of bread and other necessities has skyrocketed, and inflation has led to protests as people struggle to survive.

Traditional methods, like raising interest rates or limiting currency use, have not worked well. Zimbabwe has tried changing its currency multiple times since 2008, but this hasn’t solved its economic issues. In Argentina, repeated currency resets haven’t improved trust in the currency.

Besides hurting the economy, hyperinflation damages society, making inequality worse. People who have access to foreign currencies or assets are better protected, while others suffer as their national currency loses value. To protect their savings, many people look for alternatives, including cryptocurrencies, which can help them hold money without relying on their country’s failing currency.

Cryptocurrencies as a Solution

In countries hit by hyperinflation, cryptocurrencies have grown in popularity. Bitcoin and stablecoins have become valuable tools, offering a safer way to store wealth and make transactions where traditional systems are failing.

Bitcoin’s Role

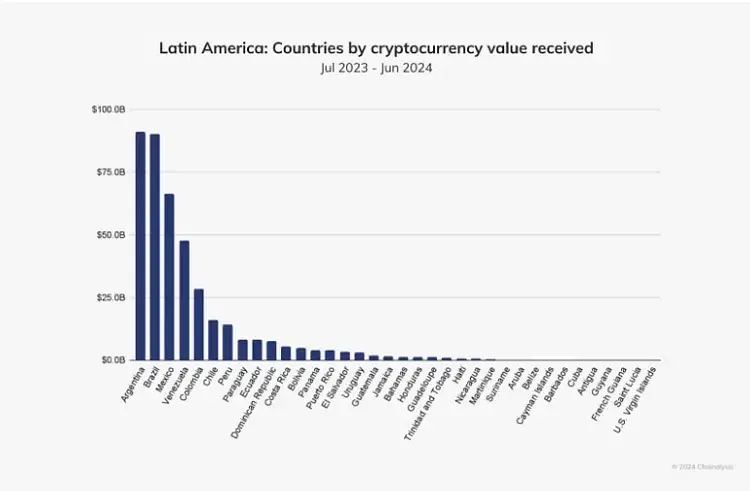

In Argentina, where inflation reached 276% in 2024, Bitcoin has become a way for people to protect their money from losing value. Unlike regular money, there’s a limit of 21 million Bitcoins, so it can’t be printed in large amounts, making it appealing for people in high-inflation countries. Argentina has one of the most active Bitcoin markets, with $91.1 billion in cryptocurrency transactions in 2024 alone.

Still, Bitcoin’s value can change a lot, which makes it risky for daily transactions. Some Argentinians use Bitcoin to protect their money, while others prefer stablecoins for daily purchases since they are less volatile.

Stablecoins for Everyday Use

Stablecoins, like USDT and USDC, are digital currencies linked to the US dollar, making them more stable than Bitcoin. These coins have become vital in countries like Argentina and Venezuela, where people need a reliable currency for daily expenses. In Argentina, stablecoins make up 61.8% of all crypto transactions, which is much higher than the global average.

As the Argentine peso lost more value in 2023, stablecoin transactions increased, reaching over $10 million monthly by the end of the year. In Venezuela, stablecoins help people protect their savings and make everyday purchases, despite the country’s economic struggles.

Crypto for Financial Services and Remittances

Cryptocurrencies have also changed the way people in struggling economies access financial services and send money across borders. In Venezuela and Argentina, people rely on DeFi platforms, which allow them to save and borrow money outside the regular banking system. For Venezuelans abroad, sending money home through cryptocurrencies like Bitcoin or stablecoins is faster and cheaper than traditional money transfers, giving families a better chance to survive hyperinflation.

Practical Use of Cryptocurrencies in Various Countries

- Brazil

In Brazil, people and businesses use stablecoins for cross-border payments and as protection against inflation. Companies prefer stablecoins because they can handle international trade without the problems of an unstable currency. In 2024, stablecoin transactions increased by 207% in Brazil. - Argentina

Hyperinflation has led many Argentinians to use stablecoins for all kinds of purchases, from groceries to utility bills. They prefer stablecoins over Bitcoin for daily needs because of their stability. A peer-to-peer (P2P) market has also grown, allowing people to trade digital currencies without dealing with banks or high taxes. - Venezuela

In Venezuela, where inflation is high, cryptocurrencies have become essential. Although the government launched its own cryptocurrency, Petro, it failed to gain public trust. People have instead adopted Bitcoin and stablecoins. In 2024, 9% of remittances sent to Venezuela were in cryptocurrency, offering families a faster, cheaper way to get support. - Zimbabwe

Zimbabweans have faced extreme inflation for years, making cryptocurrencies a valuable way to store savings and conduct business. While the P2P market isn’t as strong as in Argentina or Venezuela, awareness of cryptocurrencies is growing. - Nigeria

Nigeria has one of the largest cryptocurrency markets in Africa. Even though the government introduced a digital currency called eNaira, people prefer using decentralized cryptocurrencies like Bitcoin for storing value and cross-border payments. In 2024, Nigeria was ranked second worldwide in crypto adoption.

Conclusion

Cryptocurrencies have become an important tool in countries dealing with hyperinflation. They offer a way for people to protect their savings and complete transactions when their national currency isn’t reliable. But while cryptocurrencies provide support, they can’t fully solve the problems caused by hyperinflation. Lasting solutions require governments to make good economic policies and rebuild trust in the currency. Cryptocurrencies can help people survive financial crises but are only part of the broader solution needed for true stability.

This simplified article offers a general view of how cryptocurrencies like Bitcoin and stablecoins have helped people in countries facing hyperinflation. Remember, this information is for general knowledge and isn’t financial or investment advice.